The Cross Border Adjustment Mechanism (CBAM) marks a significant milestone in the EU’s environmental strategy, directly impacting UK SMEs in the aerospace and defence industries. Understanding the framework and preparing for the forthcoming reporting and financial obligations become paramount.

What is CBAM?

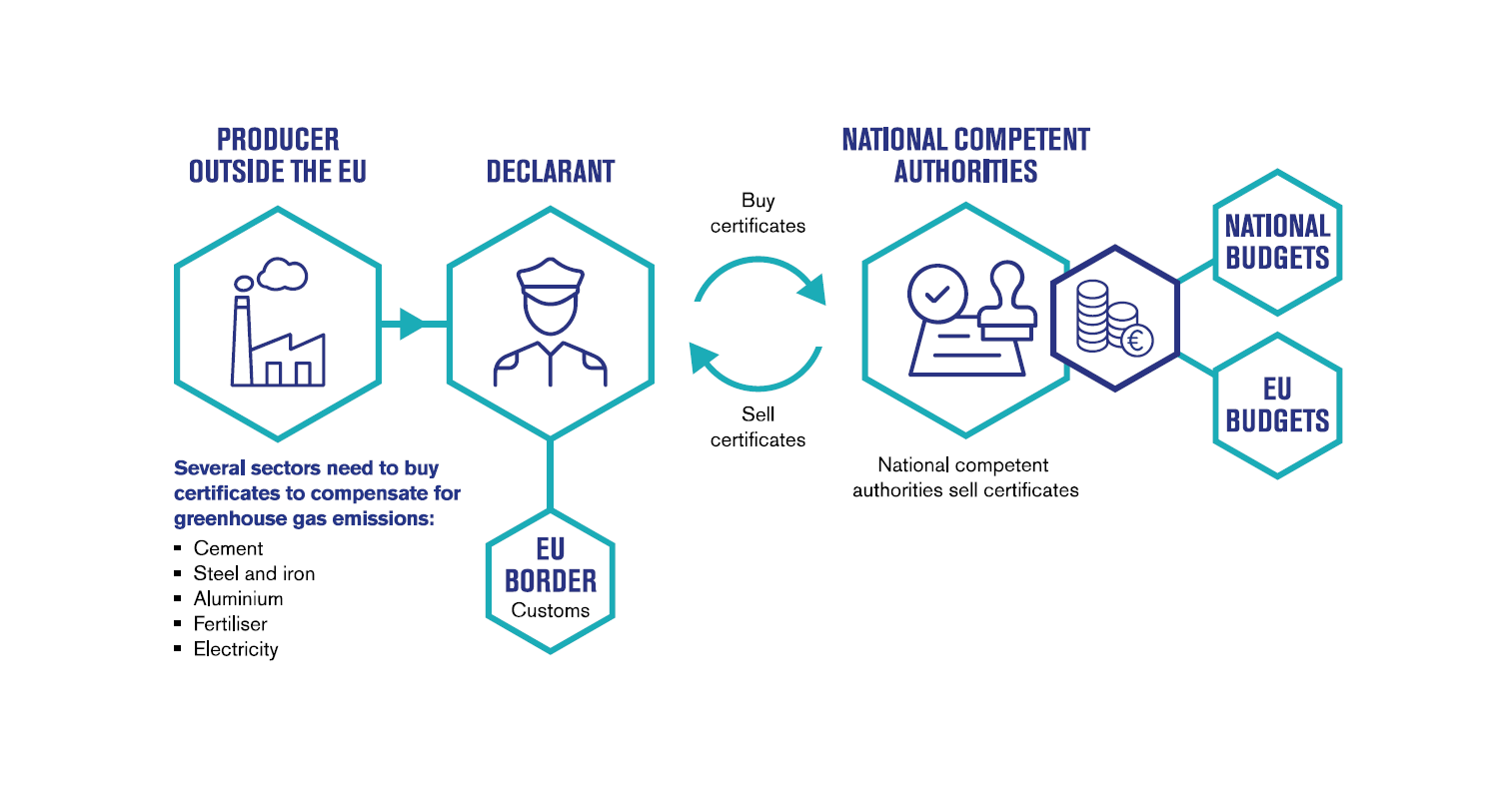

The Cross Border Adjustment Mechanism is designed to prevent carbon leakage by imposing a carbon price on imports of certain goods into the EU.

This innovative mechanism aims to ensure that ambitious climate efforts within the EU do not lead to a disadvantage in the international markets, by levelling the playing field between EU producers subject to carbon pricing and producers in countries with less stringent emissions standards.

Phases of CBAM & Implications for Non-EU Importers

October 2023 – December 2025: CBAM transitional phase.

- Goods falling within CBAM’s scope are required to report the greenhouse gas emissions embedded in their imports.

- For non-EU importers in the UK aerospace industry, this phase necessitates a proactive approach to understanding and preparing for the upcoming reporting requirements. This ensures that goods entering the EU market are competitively priced by accounting for the carbon costs associated with their production.

January 2026: Mechanism’s full implementation to commence.

- Financial adjustments in the form of carbon tariffs will be applied.

CBAM process steps for SMEs

In April 2024 we published a GHG Guidance document – a comprehensive guide based on the Greenhouse Gas Protocol, specifically tailored to the aerospace and defence sectors.

In this publication we included an overview of CBAM and the process steps for SMEs to achieve compliance.

We identified seven process steps that SMEs should follow, from understanding the scope through to calculating imports and certification, as shown below:

- Understand the scope and Requirements: Identify if your imports are covered by CBAM

- Register with the CBAM Authority: Register your business for CBAM reporting

- Collect Data on Imported Goods: Gather data on the CO2 emissions of imports

- Calculate CO2 emissions: Calculate your imports total CO2 emissions

- Submit the Emissions Report: Report emissions via the EU portal during the transitional phase

- Verification: Get the emissions report verified by an accredited third party

- Purchase CBAM Certificates (when required): Buy certificates for the embodied emissions of your imports starting in 2026

By following these steps for reporting greenhouse gas emissions, UK SMEs can navigate the complexities of CBAM, ensuring their products remain competitive in the EU market while contributing to the global effort to mitigate climate change.

Want to learn more about how to report greenhouse gas emissions including a worked example here?

Want to learn more about how to report greenhouse gas emissions including a worked example here?

Express your interest in our ESG programme on the attached form to receive a link to the full document here.